There's one simple answer...the credit bureaus KNOW that you don't have the knowledge, resources and connections to follow through on ALLLLL of the statutes and regulations written out in the FCRA and FDCPA!

Would you be afraid of a small dog with NO TEETH?! HELL NO!!

As far as the bureaus, creditors and collectors are concerned you're ALL BARK with NO BITE!

SIMPLY PUT...YOU CAN'T SUE THEM and you have no idea how to hold them accountable...UNTIL NOW!

THE SOLUTION!!!

As a consumer, everyone is susceptible to the same attacks. Protection from creditors and credit reporting agencies is necessary and the consumer should be able to uphold the protections granted to them by consumer law. Inaccurate credit reporting, creditor harassment, collection defense, and foreclosure defense are top priorities of AttorneysDispute.com.

If the credit reporting agencies or the creditors fail to reasonably investigate your credit report dispute within the allotted time frame, you could be entitled to receive monetary damages should it be determined they violated the law and your rights.

Our team of Bar Certified FCRA Attorneys are chomping a the bit to help you make sure that the items on your credit reports are being reported accurately, completely and verifiably.

List of Services

-

Step 1List Item 1

In the initial phase of your credit repair journey with us, we'll collect some basic but necessary documentation from you including but not limited to, Your Experian, Equifax, TransUnion and Innovis Reports and breif survey which will tell us more about your situation.

-

Step 2List Item 2

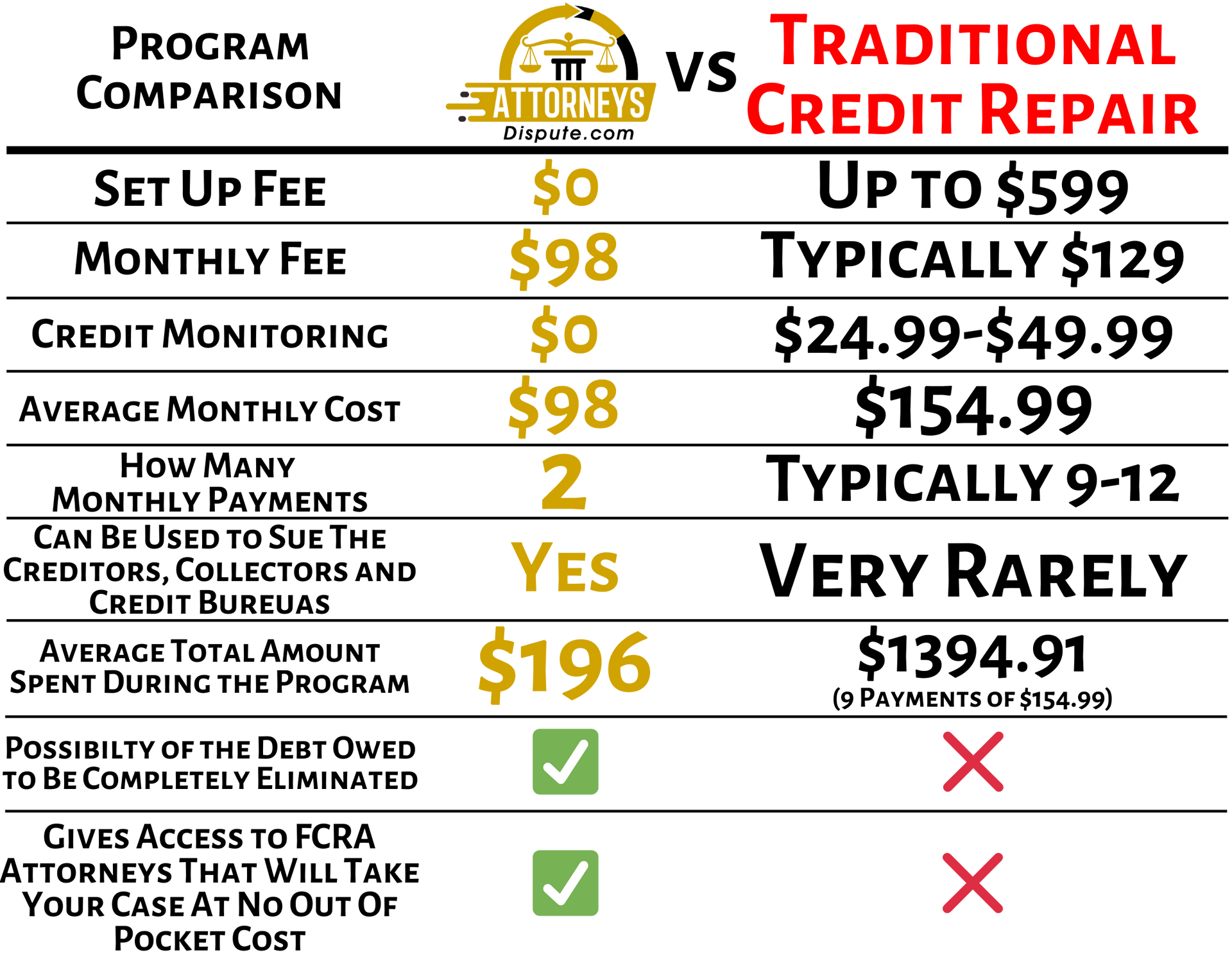

You'll make payment. We send you a link to make your first of only 2 payments of $98.

-

Step 3List Item 3

Once payment has been successfully remitted, we will schedule a phone interview with you to go over all of the expectations of the process, as well as make sure that all of the documentation that we have collected is accurate and complete.

-

Step 4List Item 4

All of your information will be forwarded to our attorneys for a forensic file review.

If they believe that there are errors on your reports or in the submitted documentation that are egregious enough to take to court, they will accept your file and meet with you directly to discuss the rest of the process.

-

Step 5

Any negative items in question will then be disputed by the attorneys for up to 4 rounds (since each round of credit repair can take up to 45 days this typically equates to about 5-6 months of service).

Disputing this way gives you the best possible opportunity to get negatives that are being incompletely, unfairly, inaccurately, unverifiably or unvalidatably reported removed from the credit report permanently.

It also gives you the opportunity to possibly be awarded compensatory or punitive damages if the attorneys are able to find violations on the credit report that can be taken to court.

Everybody knows that a good attorney can go from $400 to $600/hour, depending on their specialty and what state they're in. So naturally, most people think that because we're using actual licensed FCRA attorneys that this program has to cost an arm and a leg.

The truth is, because we're doing most of the underwriting legwork, there really is no cost to be absorbed by or from the attorneys. We're essentially doing the work of their paralegals for them.

The attorneys do an in depth review of each file before they decide to accept the client because when they take on a case, they want to know they're going to win. For this reason, when they do decide to take on a client, they do it on a contingency basis, which means they only get paid if they win.

And when they do win, the payment that is due to them comes from the creditors, collectors or the credit bureaus.

So when we say there's truly no out of pocket calls for you, we mean it.